The government of Gujarat has worked really hard to connect every village, town, and city to each other on roadways. Thus, Gujarat’s government updated road rules with every new construction. Every vehicle has to pay the tax imposed upon them regardless of whether the vehicle is new or old. Vehicle owners are liable to pay their taxes to the transportation department of Gujarat. So, let us learn how to Calculate & Pay the Gujarat Road Tax Online.

How to Calculate Gujarat Road Tax Bill Amount:

You can calculate your road tax by considering a few details like a vehicle, Age, capacity, vehicle age, etc. You can pay your tax in one go. Anyone who buys a vehicle should pay their tax while getting it.

Gujarat’s road tax is quite different from other states. It’s simple and easy comparatively. Follow the upcoming instructions to pay your road tax with less complexity.

| Vehicle’s Age |

Amount |

|

New or less than 8 years old |

6% of the vehicle’s cost |

|

Older than 8 years |

15% of the vehicle’s cost |

|

Older than 15 years |

1% of the vehicle’s cost |

How to Pay Gujarat Road Tax Online 2025

Step:1

- Visit the official Vahan Portal i.e., vahan.parivahan.gov.in.

- Enter the login details that include the vehicle registration number, your state, and the RTO, and click on Proceed.

Step 2:

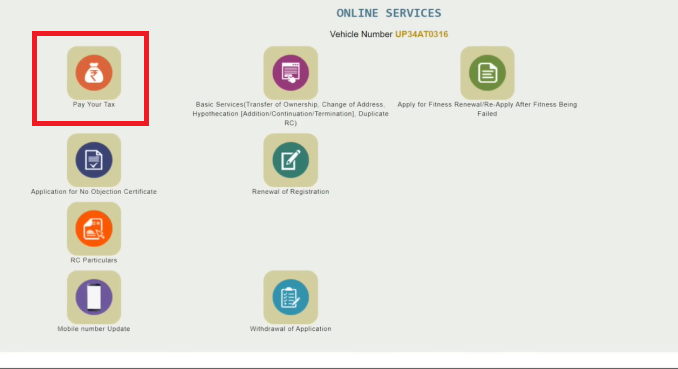

- After clicking on proceed you will be directed new dashboard.

- Where you have to select “Pay Your Tax” option to proceed future to pay your Gujarat Road Tax Bill online.

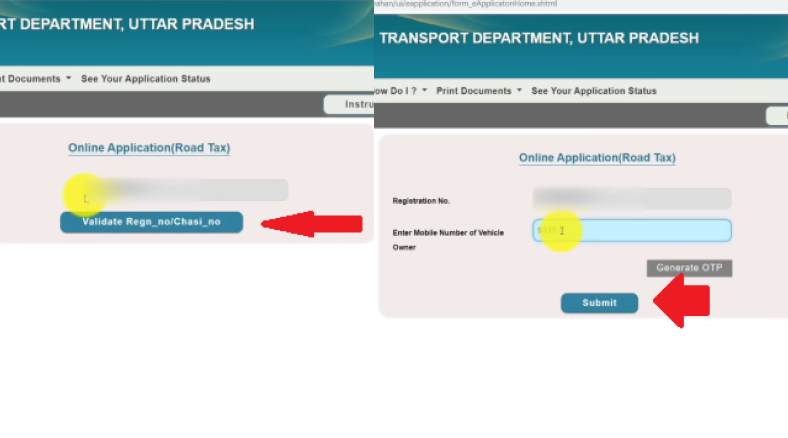

Step 3:

- Now an application window will appear on your screen where you have to add your Vehicle registration number and click on the button below.

- Then you will have to enter the registered mobile number that you have with your vehicle, and click on “generate OTP”.

- After the mobile number verification, you can click on submit. To further move on with paying the Gujarat Road Tax bill Online.

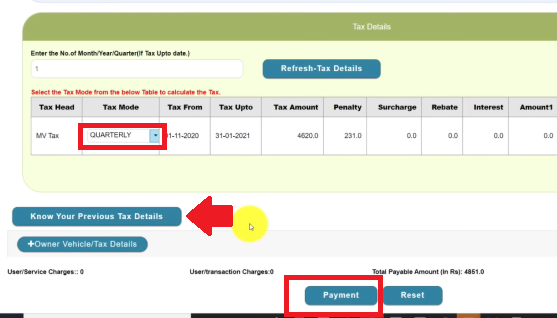

Step 4:

- A new tax bill details will pop up on your screen. Where you have to select in tax mode how much payment are you willing to make. That is Yearly, quarterly, and Monthly.

- After selecting the tax mode option, you can use the “Previous Tax Details” option to verify your road tax payment.

- Then Click on the Payment option to pay your Gujarat Road Tax Bill Online.

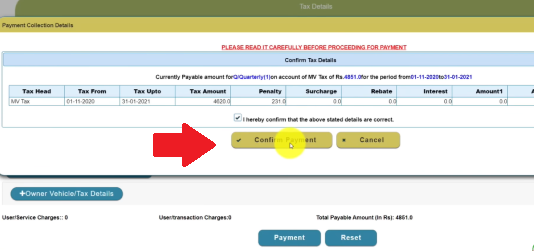

Step 5:

- After choosing the payment option a bill payment confirmation window will appear on your screen. Verify and click on “Confirm Payment”.

Step 6:

- Now, you will able to witness a payment gateway window where your payment id and amount will be displayed. Cross-check and then click on continue.

- Various Modes of payment will appear on your screen – Credit card, debit card, UPI, and Net banking.

- Select the needed and make the payment.

- After paying your Gujrat Road Tax bill online you can save the billing details and download a PDF.

Area and Road Codes in Gujarat

|

Ahmedabad |

GJ-1 |

|

Bardoli |

GJ-19 |

|

WIAA |

GJ-1-W |

|

Dahod |

GJ-20 |

|

Mehsana |

GJ-2 |

|

Navsari |

GJ-21 |

|

Rajkot |

GJ-3 |

|

Rajpipla |

GJ-22 |

|

Bhavnagar |

GJ-4 |

|

Anand |

GJ-23 |

|

Surat |

GJ-5 |

|

Patan |

GJ-24 |

Frequently Asked Questions

In Gujarat, Road tax is collected in lump amounts. You don’t have to pay for it every month.

Vehicle’s age, type, wait, usage, etc.

For two-wheelers, it’s 6% but this might change with respect to the vehicle’s age. Four-wheelers 6%., might change with the vehicle’s age.

The road tax rate for Autos is 2.5% .

Add Comment