How to Apply for HDFC Credit Card: The Indian credit card industry has been facing an uplift since the startup culture. There are many leading banks offering a variety of credit cards with tons of offers and bonuses. However, there’s a prominent name that everyone considers when it comes to credit cards, which is none other than HDFC Bank.

From safety against online fraud to minimal credit card fees, one can’t go wrong with HDFC Bank. However, most people keep wondering how to apply for HDFC credit card, which might sound like rocket science to some, but it is as easy as shopping online.

Without talking much about vague stuff, let’s take a deep dive into how to apply HDFC credit card, eligibility criteria, types, and all the stuff you should know about. Let’s get started

Table of Contents:

- Eligibility criteria for HDFC credit card

- Types of Credit Offered By HDFC

- How to Apply for HDFC Credit Card Online

- How to Apply for HDFC Credit Card Offline

- Fees & Charges For HDFC Credit Card

- How To Activate HDFC Credit Card

Eligibility criteria for HDFC credit card:

There are five critical points that HDFC Bank considers. If you pass all the given eligibility criteria points, you can apply:

1. Residential Status

HDFC Bank provides its customers an excellent service and ease while applying for a credit card. However, the applicant should have Indian nationality for most HDFC credit cards. There are many lenders in the market that offer credit cards to non-Indians as well, but HDFC only allows such exceptions for NRIs.

2. Income

Just like other leading banks, HDFC also verifies a regular source of income for applicants. One should be a self-employed businessman, a professional service provider, or a salaried person to accommodate HDFC credit card benefits.

If the applicant is earning 50,000 INR per month, there are several credit card options to choose from. However, the same can’t be said for a person with 20,000 INR earnings. Some other factors are also considered while offering the credit card and credit limit.

The average income required for an applicant is 1,44,000 rupees per annum or 12,000 rupees per month. The applicant is required to submit the latest income tax returns copy for income proof. Also, a person with a poor credit score may have a different credit limit than someone, who has a higher credit score for the same income.

3. Age

RBI has a strict guideline for who can get the credit card and who can’t. Thus, HDFC bank customers require customers to be at least 18 years of age, and the maximum age limit is 70 years old.

4. Credit History

As discussed before, credit score plays a crucial role in testing eligibility and spending limit for a customer. History of paying back debts, any bounces, and the number of hard inquiries in a specific period are considered.

Someone with an existing credit card is also eligible for a new HDFC credit card. However, monthly income and spending are also considered to ensure eligibility for card and spending limit.

5. Bank Account

The applicant must have a bank account, and it is not mandatory to have the account in HDFC Bank. It must be a salary or savings bank account to verify income and spending history. It is important to have no overdrafts and maintain of minimum balance in the account.

Once the applicant is eligible for the credit card, he/she can apply and get a credit card within a couple of days of applying. After getting your first card, it is time to learn how to activate an HDFC credit card online.

Types of Credit Offered By HDFC:

Being a leading bank in the Indian market, HDFC offers different types of credit cards for different needs with unique features, offers, and bonuses. As you are learning how to apply HDFC credit card, it is crucial to understand your requirements, the services you use the most, and what kind of offers provide the best value.

-

Regular Credit Cards

Suitable For: Ideal for first-time users, offers convenience, safety, and benefits like reward points and fuel surcharge waivers.

-

Shopping Credit Cards

Suitable For: Rewards and benefits for shopping, access to airport lounges, and fuel surcharge waivers.

-

Premium Credit Cards

Suitable For: Higher credit limits, more reward points, and lifestyle benefits like airport lounge access.

-

Super Premium Credit Cards

Suitable For: Exclusive benefits like lounge access, golf games, concierge services, and best-in-class rewards.

-

Commercial or Business Credit Cards

Suitable For: Helps manage business expenses, offers savings on travel, and provides business tools.

-

Co-branded Credit Cards

Suitable For: Tailored benefits for specific use (e.g., travel, shopping, entertainment), extra rewards.

-

CashBack Credit Cards

Suitable For: Earn cash back on everyday spending, and discounts on shopping and dining.

-

Lifestyle Credit Cards

Suitable For: Offers and benefits on lifestyle expenditures, higher reward points.

-

Secured Credit Cards

Suitable For: Available against fixed deposit, no income proof required.

-

Travel Credit Cards

Suitable For: Exclusive rewards on travel-related spending, deals on flights, stays, and transportation.

-

Fuel Credit Cards

Suitable For: Rewards on fuel purchases, fuel points redeemable for free fuel, or statement credit.

How to Apply for HDFC Credit Card Online?

Once you have figured out the right type of credit card for your needs, you can apply for the desired one online and offline.

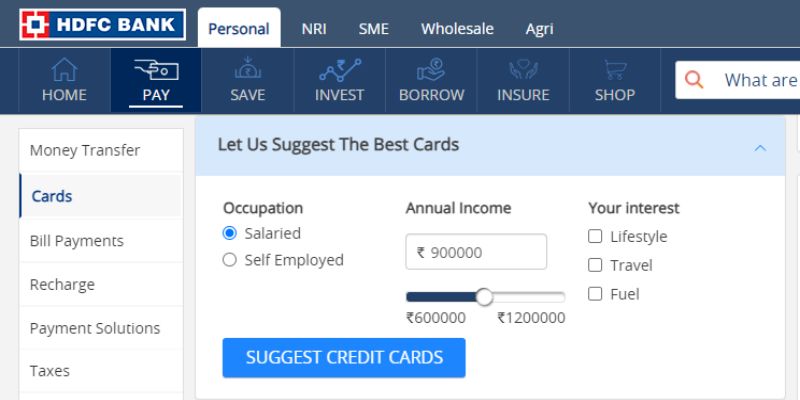

Steps to apply for HDFC Credit Card online:

Step 1: Open the HDFC Bank official website in any web browser of your choice.

Step 2: On the main page, you can find the ‘Credit Cards’ section. Once you click on it, you will be redirected to a new page which requires you to enter your mobile number and details.

Step 3: Fill out the required details like your mobile main number, and your PAN card number. If you don’t have a PAN card nearby, you can use DOB as the alternative verification method.

Step 4: Click on Get OTP and enter it into the given section. On the next page, you will be asked to fill in your name, PAN card number, employment type, and email ID. Hit the ‘check best offers’ or ‘submit’ button.

Step 5: Now HDFC Bank will fetch your credit history, your CIBIL score, and some other details to test eligibility.

Step 6: If you are eligible for an HDFC bank credit card, you will be given options to select from the different variants available to you.

Step 7: Select the credit card, and check for features and benefits. After selecting the right one, you are required to do online KYC and fill in your bank details and other information.

Step 8: HDFC bank will process all this information and reach out through SMS and Email to verify the credit card request is approved.

Step 9: Now, the credit card will be delivered to your address. Applicants are required to sign the document while accepting the delivery and they are required to provide proof of identity.

Step 10: Congratulations, you have successfully attained an HDFC bank card by now. The only thing left in using the credit card is to activate it.

How to Apply for HDFC Credit Card Offline?

Applying for an HDFC credit card offline is much easier because you get assistance from sales executives from the branch.

Steps to apply for HDFC credit Card Offline:

Step 1: Visit the nearest HDFC branch in your area. You can locate the nearest branch through Google Maps or by using the HDFC bank branch location service online.

Step 2: Visit the branch with the following documents – Aadhar Card, PAN card, Debit Card, and photocopy of tax filing.

Step 3: Talk to the sales executive about the current offers with HDFC credit cards and learn about different variants.

Step 4: Now the HDFC bank sales executive will check your eligibility and let you know about what type of credit card you are eligible for.

Step 5: Choose the one and apply for it. If you have an existing debit card in HDFC Bank, the process will be easier and quicker.

Step 6: You will get the HDFC bank credit card to the given address and you need to verify your identity using any government official identity card.

Also Read: HOW TO INCREASE HDFC CREDIT CARD LIMIT?

Fees & Charges For HDFC Credit Card:

Charges vary from one card to another credit card. If you are signing up for a basic HDFC bank credit card, then the charges are as low as 499 rupees. Below are 12 popular HDFC credit card variants with their fees:

| HDFC Credit Card Types | Fees | |

| 1 | HDFC Bank Regalia First Card | Rs.1,000 |

| 2 | HDFC Bank Regalia Card | Rs.2,500 |

| 3 | HDFC Bank Diners Club Black Card | Rs.10,000 |

| 4 | HDFC Bank Money-Back Credit Card | Rs.500 |

| 5 | HDFC Freedom Credit Card | Rs.500 |

| 6 | HDFC Bank Platinum Times Card | Rs.1,000 |

| 7 | HDFC Bank Diners ClubMiles Card | Rs.1,000 |

| 8 | HDFC Millenia Credit Card | Rs.1,000 |

| 9 | InterMiles HDFC Bank Diners Club | Rs.5,000 |

| 10 | Tata Neu Plus HDFC Bank Credit Card | Rs.499 |

| 11 | Swiggy HDFC Bank Credit Card | Rs.500 |

| 12 | Shoppers Stop HDFC Bank Credit Card | Lifetime Free |

Note: Price will vary depending on the type of credit card you choose.

How To Activate HDFC Credit Card?

Once you get the HDFC bank credit card, you get an instruction manual that guides activation as well as other key things to know. So, it is time to activate it. You just need to follow a few basic steps and the misery of finding how to activate HDFC credit card will be gone.

Steps to Activate HDFC Credit Card:

Step 1: Visit the MyCards portal of HDFC Bank and log in to this website using your mobile number and OTP.

Step 2: Click on the card control option on the same page and you can find your credit card settings here.

Step 3: Click on the ‘Card Control’ button and you can enable transactions. If you haven’t set any pin, then you can find the receive green pin button here.

Step 4: As you tap the enable transaction button, enter the green pin and you are good to go. Your card is activated for online and offline transactions.

Bottom Line:

We hope that the given step-by-step guide will assist you in approving your first HDFC bank credit card. One key thing to know, if you do not activate your HDFC credit card within 37 days of accepting the courier, your credit card will be closed for safety measures.

More Article Related to HDFC:

- HOW TO CHECK HDFC CREDIT CARD APPLICATION STATUS ONLINE

- How to register for HDFC Credit Card Net banking

Add Comment